Percentage of federal taxes taken out of paycheck

For a single filer the first 9875 you earn is taxed at 10. Calculate Federal Insurance Contribution Act taxes using the latest rates for Medicare and Social Security.

How To Calculate Federal Income Tax

62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a.

. The federal income tax has seven tax rates for 2020. Find Everything about your Search and Start Saving Now. Nebraska like most states also deducts money to pay state.

What percentage of my paycheck is withheld for federal tax. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. The federal income tax has seven tax rates for 2020.

Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges. Discover Helpful Information And Resources On Taxes From AARP. The Social Security tax is 62 percent of your total pay until you reach an annual.

Your 2021 Tax Bracket To See Whats Been Adjusted. Supplemental tax rate remains 22. Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net earnings.

Ad Compare Your 2022 Tax Bracket vs. Backup withholding rate remains 24. Thats the deal only for federal income.

There are also rate and bracket updates to the 2021 income tax withholding tables. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62.

That 14 is your effective tax rate. Determine if state income tax and other state and local taxes. Ad Helping Businesses Manage Their Tax Responsibilities Through Remote Tax Tools.

Also What is the percentage of federal taxes taken out of a paycheck 2021. There are certain deductions like federal income and FICA taxes taken from your paycheck no matter which state you call home. The federal withholding tax has seven rates for 2021.

The federal government receives 124 of an employees income each pay period for Social Security. Federal income taxes are paid in tiers. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

Ad Choose Your Paycheck Tools from the Premier Resource for Businesses. You owe tax at a progressive rate depending on how much you earn. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes.

Federal income tax and FICA tax. 4 rows The withholding tables have tax brackets of 10 percent 12 percent 22 percent 24. What percentage of federal taxes is taken out of paycheck for 2020.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket. Your employer will match that by.

FICA contributions are shared between the employee and the employer. This is divided up so that both employer and employee pay 62 each. Ad Look For Awesome Results Now.

The employer portion is 15 percent and the. 10 percent 12 percent 22 percent 24 percent 32 percent 35. See where that hard-earned money goes - Federal Income Tax Social Security and.

Withholding from your paycheck is done on what is known as the graduated system. The other federal taxes do have standard amounts they are as follows. These taxes are deducted from your paycheck in fixed percentages.

10 12 22 24 32 35 and 37. Get the Paycheck Tools your competitors are already using - Start Now. Social Security tax and Medicare tax are two federal taxes deducted from your paycheck.

The federal withholding tax rate an employee owes depends on their income level and filing. Social Security tax 124. How Your Paycheck Works.

Every pay period your employer will withhold 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. Also Know how much in taxes is taken out of my paycheck.

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Which States Pay The Most Federal Taxes Moneyrates

2022 Federal State Payroll Tax Rates For Employers

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Is An Employer Allowed To Stop Taking Federal Taxes Out Of My Paycheck So That I Can Take Advantage Of A Tax Credit Quora

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Which States Pay The Most Federal Taxes Moneyrates

How To Calculate 2019 Federal Income Withhold Manually

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Income Taxes What You Need To Know The New York Times

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Paycheck Taxes Federal State Local Withholding H R Block

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

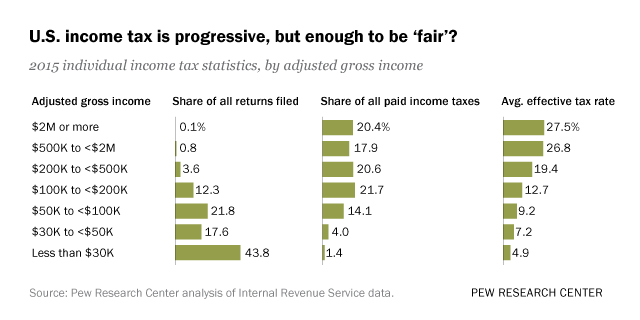

Who Pays U S Income Tax And How Much Pew Research Center

Irs New Tax Withholding Tables